Date: 2024-12-11

Links to Federal Register: HTML, PDF

Document Number: 2024-28371, RIN: 1545-BR37

Action: Notice of proposed rulemaking.

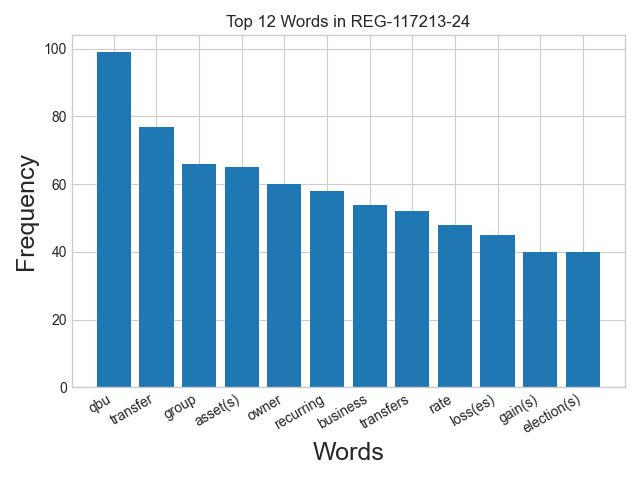

Abstract: This document contains proposed regulations relating to the determination of taxable income or loss and foreign currency gain or loss with respect to a qualified business unit. The proposed regulations include an election that is intended to reduce the compliance burden of accounting for certain disregarded transactions between a qualified business unit and its owner. This document also includes a request for comments relating to the treatment of partnerships and controlled foreign corporations.

| Notable phrases | Frequency |

|---|---|

| 987 QBU | 80 |

| recurring transfer | 57 |

| functional currency | 26 |

| unrecognized section 987 gain or loss | 22 |

| grouped assets | 20 |

| yearly average exchange rate | 20 |

| recurring transfer group election | 20 |

| spot rate | 15 |

| transfers between a section 987 QBU | 5 |

| transactions between a section 987 QBU | 4 |

| ordinary course of the business | 4 |

| principles of the arm's length standard | 4 |

| 50 percent of the total amount of grouped assets | 3 |

| Reg. Cites | Frequency |

|---|---|

| 1.987-4(d)(2) | 10 |

| 1.987-4 | 9 |

| 1.987-2(f)(1) | 8 |

| 1.987-5(f) | 5 |

| 1.367(b)-3 | 4 |

| 1.987-1(g) | 4 |

| 1.987-9 | 4 |

| 1.987-2 | 3 |

| 1.987-4(e)(2)(iii) | 3 |

| 1.987-15 | 3 |

| 1.987-4(d)(10) | 3 |

| 1.482-1(b) | 3 |

| 1.987-2(f)(4) | 3 |

| 1.987-4(d) | 3 |

| 1.367(b)-3(g) | 2 |

| 1.987-11 | 2 |

| 1.987-5) | 2 |

| 1.987-6 | 2 |

| 1.987-2(f)(6) | 2 |

| 1.987-9(b)(5) | 2 |

| Sec. Cites | Frequency |

|---|---|

| 987 | 135 |

| 987(3) | 12 |

| 989(c) | 2 |

| 988 | 2 |

| 989(a) | 2 |

| 7805(f) | 2 |

| 987(1) | 1 |

| 989(c)(5) | 1 |

| 861 | 1 |

| 7805 | 1 |

| 986(c) | 1 |

| 362(e) | 1 |

| 989 | 1 |

Statistics

Number of pages: 9, words: 8,816, sentences: 301

Average words per sentence: 29