Date: 2019-06-21

Links to Federal Register: HTML, PDF

(Proposed Regulation: REG-105600-18 HTML, PDF)

Document Number: 2019-12437, RIN: 1545-BO54

Action: Final and temporary regulations.

Abstract: This document contains final regulations that provide guidance to determine the amount of global intangible low-taxed income included in the gross income of certain United States shareholders of foreign corporations, including United States shareholders that are members of a consolidated group. This document also contains final regulations relating to the determination of a United States shareholder's pro rata share of a controlled foreign corporation's subpart F income included in the shareholder's gross income, as well as certain reporting requirements relating to inclusions of subpart F income and global intangible low-taxed income. Finally, this document contains final regulations relating to certain foreign tax credit provisions applicable to persons that directly or indirectly own stock in foreign corporations.

| Notable phrases | Frequency |

|---|---|

| tested income | 633 |

| pro rata share | 303 |

| subpart F income | 215 |

| gross tested income | 194 |

| tested income CFC | 172 |

| CFC inclusion year | 166 |

| specified tangible property | 154 |

| United States shareholder | 123 |

| GILTI inclusion amount | 122 |

| U.S. shareholder inclusion year | 77 |

| hypothetical distribution | 76 |

| tested loss CFC | 74 |

| qualified business asset investment | 73 |

| tested interest expense | 70 |

| allocated and apportioned | 70 |

| tested interest income | 69 |

| specified interest expense | 63 |

| foreign tax credit | 63 |

| deemed tangible income return | 51 |

| basis in the stock | 47 |

| net operating loss | 35 |

| net CFC tested income | 34 |

| Reg. Cites | Frequency |

|---|---|

| 1.951A-2(c)(3) | 41 |

| 1.951A-2(c)(5) | 37 |

| 1.952-2 | 15 |

| 1.1502-51 | 14 |

| 1.861-12(c)(2)(i)(B)(1)(ii) | 12 |

| 1.951A-3(e)(3)(ii) | 12 |

| 1.965-2(f)(2)(i) | 12 |

| 1.951A-7 | 11 |

| 1.951-1(b)(1)(i) | 10 |

| 1.951A-1(c)(3)(iii) | 10 |

| 1.965-7(e)(2)(ii)(B) | 10 |

| 1.78-1 | 9 |

| 1.951A-3 | 9 |

| 1.951A-3(b) | 8 |

| 1.954-1(d)(6) | 8 |

| 1.951A-2 | 8 |

| 1.951A-1 | 7 |

| 1.951-1 | 7 |

| 1.951A-6 | 7 |

| 1.861-12 | 6 |

| Sec. Cites | Frequency |

|---|---|

| 951A | 146 |

| 78 | 45 |

| 965(n) | 42 |

| 958(a) | 36 |

| 704(b) | 32 |

| 954(b)(4) | 29 |

| 965(a) | 28 |

| 952(c)(1)(A) | 28 |

| 952(c)(2) | 25 |

| 952(c) | 24 |

| 965 | 22 |

| 951A(c)(2)(A)(i)(II) | 21 |

| 958(a) | 20 |

| 965(c) | 19 |

| 904 | 18 |

| 951(a)(2)(B) | 17 |

| 951(a)(2)(A) | 17 |

| 951(a)(1)(A) | 16 |

| 951A(d)(3) | 16 |

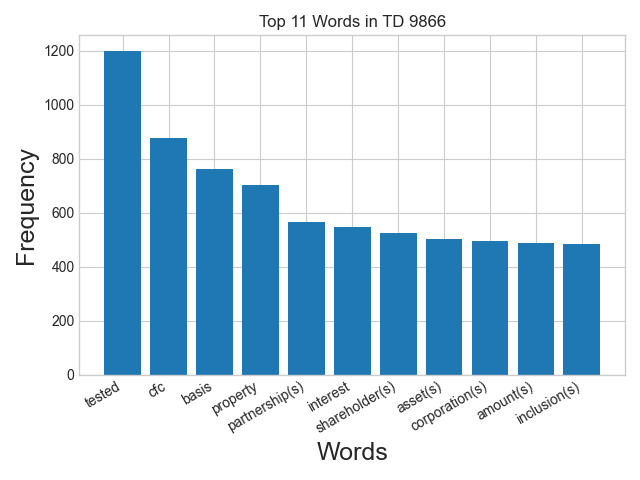

Statistics

Number of pages: 83, words: 99,465, sentences: 3,206

Average words per sentence: 31