Date: 2024-10-10

Links to Federal Register: HTML, PDF

(Proposed Regulation: REG-124064-19 HTML, PDF)

Document Number: 2024-23132, RIN: 1545-BP55

Action: Final rule.

Abstract: This document contains final regulations that terminate the continued application of certain tax provisions arising from a previous transfer of intangible property to a foreign corporation when the intangible property is repatriated to certain United States persons. The final regulations affect certain United States persons that previously transferred intangible property to a foreign corporation.

| Notable phrases | Frequency |

|---|---|

| intangible property | 112 |

| ip | 73 |

| u.s. transferor | 55 |

| qualified domestic person | 49 |

| adjusted basis | 30 |

| subsequent transfer | 27 |

| transferee foreign corporation | 24 |

| gain recognized | 11 |

| required adjustments | 10 |

| fair market value | 9 |

| earnings and profits | 8 |

| related transactions | 8 |

| transferred intangible property | 8 |

| domestic person's adjusted basis | 6 |

| Reg. Cites | Frequency |

|---|---|

| 1.904-4(f)(2)(vi)(d) | 12 |

| 1.367(d)-1T | 8 |

| 1.367(d)-1T(e)(1) | 6 |

| 1.882-4(b)(1) | 5 |

| 1.367(d)-1(f)(4)(i)(a) | 5 |

| 1.960-1(c) | 5 |

| 1.954-1(c) | 5 |

| 1.367(d)-1(f)(5) | 5 |

| 1.367(d)-1T(f)(1) | 4 |

| 1.367(d)-1T(c) | 4 |

| 1.367(d)-1(f)(4)(iv) | 4 |

| 1.904-4(f)(2)(vi)(d)(4) | 4 |

| 1.904-4 | 4 |

| 1.367(d)-1T(h) | 4 |

| 1.367(d)-1T(g)(1) | 3 |

| 1.367(d)-1 | 3 |

| 1.367(d)-1T(c)(2) | 3 |

| 1.367(d)-1T(f)(1)(ii) | 3 |

| 1.6038b-1(d)(2)(iv) | 3 |

| Sec. Cites | Frequency |

|---|---|

| 367(d) | 70 |

| 311 | 7 |

| 7701(a)(43) | 3 |

| 367(d)(4) | 3 |

| 351 | 3 |

| 351(b) | 3 |

| 1361(a) | 3 |

| 851(a) | 2 |

| 904(d) | 2 |

| 856(a) | 2 |

| 992(a)(1) | 2 |

| 332 | 2 |

| 936(h)(3)(b) | 2 |

| 311(b) | 2 |

| 501(a) | 2 |

| 7805(f) | 2 |

| 951A | 2 |

| 162 | 2 |

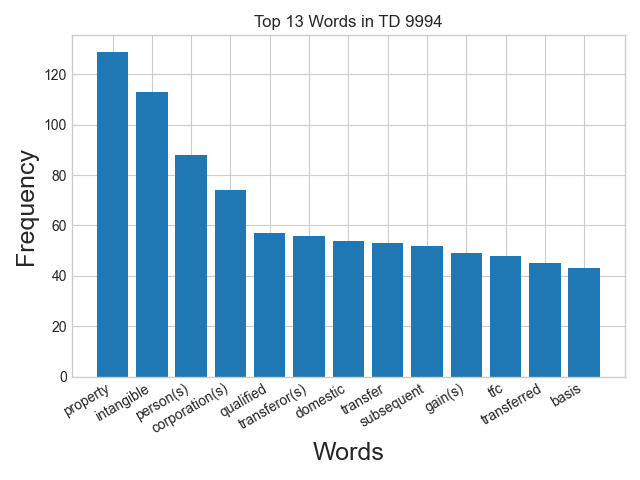

Statistics

Number of pages: 11, words: 10,600, sentences: 440

Average words per sentence: 24